Researchers at Johns Hopkins University’s Department of Civil and Systems Engineering (CaSE) and Department of Earth and Planetary Sciences have joined forces with Baltimore-based global asset manager T. Rowe Price to investigate the effects of climate on sovereign debt. The collaboration aims to uncover how unusual climate events influence economic indicators and sovereign debt, with T. Rowe Price seeking to enhance their investment strategies in the face of climate-induced economic fluctuations.

The study, which began in April 2024, examines how atypical climate events influence economic indicators, like GDP and inflation, and how these events affect sovereign debt: money borrowed by national governments through issuing bonds.

Hopkins collaborators include Whiting School of Engineering’s systems engineering expert Tak Igusa and PhD candidate Zhixi Chen, and climate scientists Ben Zaitchik and Marie-Aude Pradel of the Krieger School of Arts and Sciences’ Department of Earth and Planetary Sciences.

“T. Rowe Price wants to understand the implications of climate change on sovereign debt to inform investment decision-making. Their understanding is pivotal for identifying potential risks and opportunities within the sovereign debt market, allowing for the development of more robust investment strategies and ensuring sustainable, resilient financial planning amid current climate-induced economic fluctuations,” Chen said.

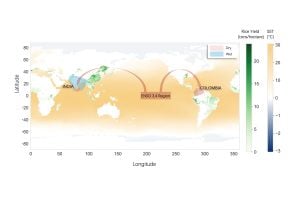

The study focuses on the impact of El Niño and La Niña events on more than 100 sovereign nations from 1980 to the present. Following this broad analysis, the researchers will conduct deeper dives into 12 specific countries, including Mexico, Brazil, and India, to examine how weather shocks affect economic sectors, like infrastructure construction and agriculture.

“Our methodology combines a systems approach with T. Rowe Price’s data on economic conditions and sovereign debt. We’re using statistical, econometric models—or models that incorporate theory, mathematics, and statistical inference—to examine the relationship between climatic weather events and a country’s key economic indicators. By looking at both climatic data and economic models we can analyze immediate shocks and long-term trends affecting debt sustainability,” said Chen.

The project has several primary goals: assessing the effects of historical El Niño and La Niña events on meteorology, hydrology, and ecology and projecting future changes; investigating the meteorological, hydrological, and ecological impacts of three very strong El Niño events on economic sectors; and analyzing how these climate impacts translate into debt market fluctuations and how they affect borrowing costs at the sovereign level.

“If we can characterize that chain of causality—from climate variability and change through to a country’s ability to service its debt—then we can better understand near-term climate risk and longer-term adaptation needs,” said Zaitchik.

“The team’s findings are expected to not only provide T. Rowe Price with a better understanding of potential risks and opportunities in the sovereign debt market, but also contribute to academic and policy discussions on integrating climate risk into economic forecasting and debt management strategies,” said Igusa.

The research team expects to present their findings by early 2025.