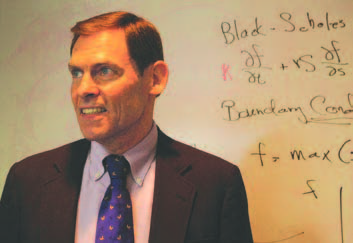

Every Tuesday this past spring semester, David Audley, PhD ’72 commuted by train from New York to Homewood to teach more than 30 graduate and undergraduate students enrolled in Mathematical Modeling of Securities and Financial Markets, a new course offered by the Whiting School’s Department of Applied Mathematics and Statistics (AMS).

“There’s huge student interest in the study of finance at universities across the country,” says Dan Naiman, chair of the department. “Math majors today are going on to work as financial analysts.”

To complement an already top-notch mathematics curriculum that includes some classes in finance, AMS has proposed a new master’s program in financial mathematics. And while the approval process moves ahead, the department decided to debut one of the offerings.

“For this class we knew we wanted someone with a strong mathematics background and wide industry experience—a senior practitioner,” says Naiman.

Fortunately, Audley, who was serving on the new program’s advisory committee, not only fit the bill, but was eager to return to the School of Engineering. Audley received his PhD in electrical engineering in 1972. His son, Christopher, earned a degree from the Whiting School in electrical and computer engineering in 1994.

Today, Audley is a part owner of two companies— Watch Hill Fund, a hedge fund, and Beacon, a peer-to-peer networking tool for bond trading—and has experience in analytic trading, risk management, securities and market research, and financial technologies. In short, he has all the skills, knowledge, and practical experience needed to teach the class.

“I hadn’t been back here for years—since Christopher graduated,” says Audley. “So returning to campus, seeing what’s changed, was interesting.” He adds, “The high level of interest in the class didn’t surprise me, though, given the number of Hopkins graduates I see on Wall Street.”

Interest is so high that Audley will return in the fall to teach the second half of the course. “Students here can go to the library and learn about the relatively new concepts I cover, but what I have to offer is first-person experience.”

“Dave is not the only alumni practitioner on board,” Naiman notes. Jim Tzitzouris ’02 got his PhD from AMS, is now a vice president at T. Rowe Price, and has been teaching Investment Science since he graduated. “Our alumni are well-positioned to help us,” says Naiman.